Corporate Governance

Basic Policy for Corporate Governance

Our basic stance on corporate governance is to seek improvement of management soundness, transparency and efficiency and increase mid-to-long-term corporate value and shareholder value.

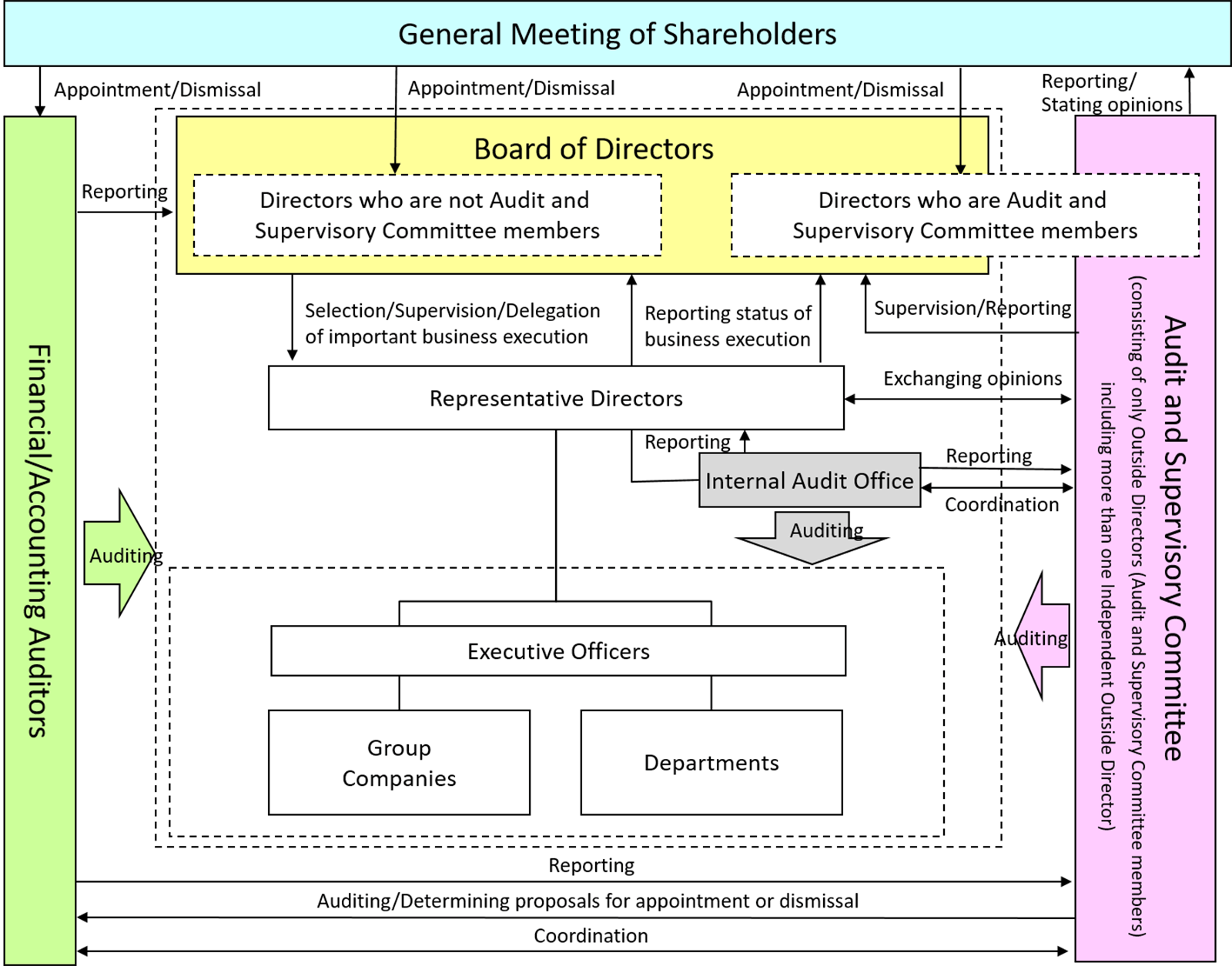

We have established the Audit and Supervisory Committee to further strengthen our governance system. The Audit and Supervisory Committee, which takes a lead role in audits, is composed entirely of outside directors (Audit and Supervisory Committee members), including multiple independent outside directors. The Audit and Supervisory Committee members, who are outside directors, have voting rights at the Board of Directors meetings and the rights to express opinions on directors’ nominations and compensation at the General Meeting of Shareholders. As a result, our management oversight functions have been further strengthened.

In addition, we have adopted the executive officer system to separate decision-making and management oversight functions from business execution functions. Certain important business execution decisions are entrusted to directors, so that the Board of Directors can deliberate on matters of particular importance. For other matters, we place emphasis on speed of management decisions by the Executive Leadership Team.

Chart of Corporate Governance System

Basic Policy for Suppliers

Coca-Cola Bottlers Japan Holdings (CCBJH) expects all of its employees to comply with the law and act ethically in all matters. We also expect our business partners (the Suppliers) who provide goods and services to CCBJH to act in the same way.

Only through the integrity the many people who are relevant to our products will we be able to deliver our refreshing image with consistency.

Both by ensuring superior quality for the goods and services we procure, and also by ensuring that our Suppliers comply with the law and act ethically, we will be able to form a sustainable society together, and therefore fulfill our social responsibilities. Therefore, CCBJH has developed the “Basic Policy for Suppliers,” and expects the Suppliers to comply with them.

We appreciate the compliance of in this matter and with the Basic Policy for Suppliers.

The policy is enacted and enforced effective January 1, 2018

Tax Basic Policy

All directors and employees of the company act with a strong sense of ethics, whether in business or personal life, as well as comply with laws and regulations, social norms, and company regulations. We at the company also recognize that properly fulfilling tax obligations is one of the fundamental and important social responsibilities of a company, and in conducting tax practice, all its group companies properly assess and pay taxes, complying with relevant laws and regulations and conforming to the basic principles, policies, and code of business conduct & ethics specified by the company, based on the basic guidelines below:

- 1. We pay taxes properly in accordance with tax-related laws and regulations.

- 2. We conduct appropriate tax management, always ensuring that there are no omissions or delays with regard to tax-related accounting and other associated actions.

- 3. We conduct efficient and continuous tax management in light of maximizing shareholders' value. We do not avoid taxes through interpretation/application that deviates from the purpose of relevant laws and regulations.

- 4. We maintain good relations with tax authorities through smooth communication with them and sincerely respond in good faith to ensure transparency and credibility in relation to tax practice.

- 5. We pay taxes on our activities in the country where the value is created and ensure that so-called 'tax havens' are not used for tax avoidance purposes.

- 6. We are committed to undertake transfer pricing using the arm’s length principle.

- 7. We have an approval process of the tax policy by directors.